Affecting Factors to the Gold Prices in the World Market

Keywords:

forecasting, gold price, Stepwise Multiple Regression AnalysisAbstract

Background and Objectives: Gold has long been considered a crucial component of the global economy due to its role as a stable and widely accepted store of value. Its physical properties, limited supply, and universal recognition render it a unique financial asset, particularly in times of economic uncertainty. As a result, gold is often used as a hedge against inflation, a safe-haven investment, and a key element in international reserves held by central banks. Given these roles, fluctuations in the global gold price are of significant interest to economists, investors, and policymakers alike. Despite gold's reputation for stability, its price is subject to considerable volatility. Various macroeconomic and financial variables both domestic and international can influence gold price movements in the global market. Understanding these influencing factors is essential for forecasting trends and making informed investment and policy decisions. Accordingly, the objective of this study is to analyse the relationships between global gold prices and a selected set of economic indicators, and to identify which of these indicators significantly affect the movement of gold prices in the world market. Specifically, this research examines the influence of the following independent variables: the WTI crude oil price, the USD/THB exchange rate, the U.S. inflation rate, the U.S. policy interest rate, the U.S. Consumer Price Index (CPI), the Dow Jones Industrial Average (DJIA), global silver prices, global copper prices, and global palladium prices. These variables have been chosen based on both theoretical relevance and empirical evidence suggesting their potential impact on gold price dynamics. The study aims to explore the strength and direction of the relationships between these factors and the global gold prices.

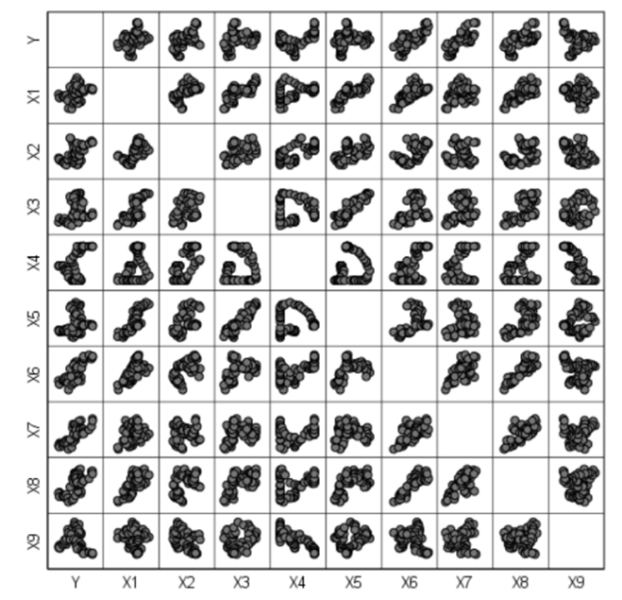

Methodology: This research adopts a quantitative approach, utilizing secondary data in the form of monthly time-series statistics collected over a 66-month period, from January 2019 to June 2024. The dataset includes one dependent variable (global gold prices) and nine independent variables. All data were sourced from reputable financial and economic databases. The initial phase of the analysis involved calculating Pearson correlation coefficients to assess the strength and direction of linear relationships between the dependent and independent variables. This step was crucial for identifying patterns and interdependencies within the data. Following the correlation analysis, stepwise multiple regression analysis was conducted to determine which independent variables significantly affect global gold prices. This statistical technique allows for the identification of the most relevant predictors by including variables that contribute significantly to the explanatory power of the model, while excluding those that do not. Finally, standard diagnostic tests were applied to confirm that the assumptions underlying multiple regression such as linearity, normality, homoscedasticity, and multicollinearity.

Main Results: The correlation analysis revealed varying degrees of relationship between the selected variables and global gold prices. Specifically, WTI crude oil prices (X1), the U.S. inflation rate (X3), the U.S. policy interest rate (X4), and the U.S. Consumer Price Index (X5) exhibited weak positive linear relationships with global gold prices (Y). On the other hand, the USD/THB exchange rate (X2), DJIA (X6), global silver prices (X7), and global copper prices (X8) demonstrated moderate positive linear correlations with gold prices. Interestingly, global palladium prices (X9) showed no statistically significant correlation with gold prices. The key factors affecting global gold prices were identified through the following regression equation: = -1109.071+57.481X2-20.900X5+46.971X7 The regression analysis further refined these insights by identifying three statistically significant predictors of gold prices in the world market: the USD/THB exchange rate (X2), the U.S. Consumer Price Index (X5), and global silver prices (X7). Together, these three variables accounted for 82.3% of the variation in global gold prices, as indicated by the coefficient of determination (R²). This suggests a strong predictive capability of the model. Notably, the USD/THB exchange rate and global silver prices were found to have positive linear relationships with global gold prices. In contrast, the U.S. CPI exhibited a negative linear relationship. All relationships were statistically significant at the 0.05 level.

Conclusions: The results of this study have important implications for multiple stakeholders. For investors, understanding the dynamics among these key indicators and global gold prices can enhance portfolio management strategies, particularly in terms of hedging and asset diversification. The positive relationship between the USD/THB exchange rate and gold prices underscores the importance of currency fluctuations in investment planning, especially for Thai investors or those dealing in emerging market currencies. The significant influence of global silver prices suggests that trends in related commodity markets should be monitored closely, as they often move in tandem due to shared industrial and investment demand. For policymakers, the findings emphasize the need to consider global commodity and currency trends when formulating monetary and fiscal policies. The inverse relationship between U.S. inflation (CPI) and global gold prices may signal shifts in investor sentiment and capital flows in response to inflationary pressures, which could affect macroeconomic stability. Future studies may extend this work by incorporating geopolitical factors, real interest rates, or broader indices such as the U.S. Dollar Index (DXY), which could yield further insights into the complexities of gold price behaviour in a globalized economy.

References

Angsusochochi, S. (2024). Techniques for Analyzing the Relationship Between Variables. Nonthaburi: Sukhothai Thammathirat Open University. (in thai)

Bongkotprapa, J. (2021). The Study Of Interdependency Between The Movement Of The Gold Price, Oil Price, Exchange Rates, And Market Return In The United States Of America And Thailand. [The thesis for the Master's degree in Management at the College of Management, Mahidol University]. (in thai)

Charoenpanit, W. (2014). Economic Factors Affecting the Price of Gold Bullion in the Global Market. Graduate Journal, Academic Year 2014, 227 – 237. (in thai)

Durongwatthana, S. (2015). Regression Models: Analytics-bases Approach. Bangkok: Danex Intercorporation. (in thai)

Gold Trade Association. (2003). Properties and benefits of gold. Gold Journal, 1(1). (in Thai)

Gold Trade Association. (2024). What will the direction of gold prices be?. Gold Journal, 21(78), 34-36. (in Thai)

Jitthavech, J. (2015). Regression Analysis. Bangkok: National Institute of Development Administration. (in Thai)

Komoltrakulwattana, Y. (2014). Factors Affecting World Gold Price. [Degree of Master of Economics School of Economics, Sukhothai Thammathirat Open University] (in Thai)

MayuriSawan, T. (2016). Regression Analysis. Khon Kaen: Department of Statistics, Faculty of Science, Khon Kaen University. (in Thai)

Nusanan, P. (2019). The factors that influence the price of gold bars in Thailand. [The Independent Study of the Master of Arts in Economics Program, Business Economics Major, University of the Thai Chamber of Commerce.] (in thai)

Panichphong, W. (2002). Regression Analysis. Bangkok: Textbook Production Center, King Mongkut's University of Technology North Bangkok. (in Thai)

Sirivathan, S., & Thongruaendee, P. (2012). Affecting factors to the gold price in the world market. [Research of North Bangkok University]. (in Thai)

Supmonchai, S. (2002). Regression Analysis for Business. Bangkok: Pinkao Publication. (in Thai)

Tamti, R. (1992). Analysis of gold content in gold alloys and gold jewelry. Department of Science Service. 40(1), 3 – 6. (in Thai)

Wetthayawikomrat, R. (2018). Factors Affecting Gold Prices in The World Market. [An Independent Study Master of Business Administration. Faculty of Commerce and Accountancy, Thammasat University] (in Thai)

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2025 Faculty of Science, Burapha University

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

Burapha Science Journal is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International (CC BY-NC-ND 4.0) licence, unless otherwise stated. Please read our Policies page for more information